[ad_1]

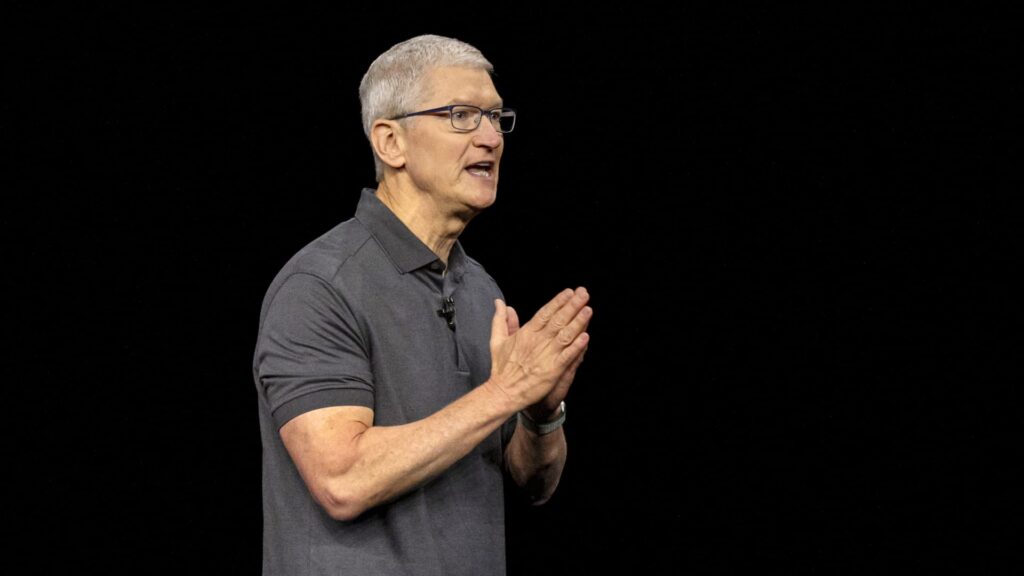

Don’t expect the earnings season to slow down just yet. About 30% of the S & P 500 is set to report earnings this week, bringing the reporting past the halfway mark. Among the companies scheduled to deliver quarterly results are Apple, McDonald’s and Pfizer. It’s been a mixed earnings season thus far. Of the companies that have posted their latest quarterly figures, 76% have exceeded expectations, according to FactSet. To be sure, there have been some notable post-earnings declines, including in shares of Alphabet, Ford and Meta Platforms. These pullbacks put pressure on the S & P 500, which fell 2.5% last week. Take a look at CNBC Pro’s breakdown of what’s expected from some of this week’s key reports. Monday McDonald’s is set to report earnings before the bell, followed by a call with management at 8:30 a.m. ET. Last quarter: MCD earnings topped analyst forecasts, with sales of the Grimace Birthday Meal driving customer traffic in the U.S. This quarter: Analysts expect double-digit earnings and revenue growth from the fast food giant, LSEG data shows. What CNBC is watching: McDonald’s shares have struggled over the past three months, losing 13% in that time, as sticky inflation and higher rates have soured sentiment around the fast food giant. Despite this downturn, Oppenheimer analyst Brian Bittner is sticking with McDonald’s as a top pick heading into earnings. “After the stock’s recent pullback, valuation sits at an attractive ~21x P/E, vs its 22x-25x historical average. We believe MCD is positioned to win [market] share regardless of the economic situation with ability to meet SSS forecasts even in a recession,” the analyst wrote. What history shows: McDonald’s only beats analyst expectations 56% of the time and is typically flat on earnings days, according to Bespoke Investment Group. Shares have fallen in two of the last three earnings days. Tuesday Pfizer is set to report earnings in the premarket. Corporate leadership is scheduled to hold a call at 10 a.m. ET. Last quarter: PFE posted disappointing revenue, adding it could cut costs if weakness in Covid-19 products persists . This quarter: The pharmaceutical giant is expected to report a steep year-over-year revenue decline, per LSEG. What CNBC is watching: Pfizer is coming into this latest earnings report limping. Shares are down more than 9% this month after the company slashed its full-year revenue guidance due to slumping Covid treatment and vaccine sales . That said, the company said last week its combination Covid and flu vaccine will proceed to a final-stage trial in a few months following positive results . Could this be a sign of a turnaround coming? Investors will be looking for clues on that front. What history shows: Pfizer has a strong track record of outperforming earnings expectations, exceeding estimates 88% of the time, according to Bespoke. That said, shares tend to struggle on earnings days, falling 0.33% on average. They have also fallen in the last two earnings days. Advanced Micro Devices is set to report earnings after the close, with a conference call scheduled for 5 p.m. ET. Last quarter: AMD results exceeded expectations despite a slowdown in the PC market . This quarter: Analysts expect the chipmaker’s earnings and revenue to be about flat from the year-earlier period, according to LSEG. What CNBC tech reporter Kif Leswing is watching: “Is the PC market about to bottom? AMD makes most of its money selling chips for PCs, and that market has been extremely slow for about two years. But perhaps a bigger question is whether promised data center sales growth — driven by demand for AI — starts showing up in the second half of the year. AMD’s top AI chip, the MI300X, started shipping in limited quantities during the third quarter, and investors want to know if it could give Nvidia a run for its money.” What history shows: AMD shares don’t tend to do well on earnings days, losing an average of 1.5%, according to Bespoke. Shares have also fallen in four of the last five earnings days. Thursday Starbucks is set to report earnings before the bell, with a call set for 7 a.m. ET. Last quarter: SBUX revenue missed expectations even as sales in China remained strong . This quarter: The coffee giant’s earnings and revenue are expected to have risen by double digits, LSEG data shows. What CNBC is watching: Investors are going into Starbucks’ latest quarterly report looking for clues on how the company is managing a slowdown in China — one of its major markets. Last month, TD Cowen analyst Andrew Charles downgraded Starbucks to market perform from outperform, noting: “While we were pleased with Starbucks China’s 3Q (June) performance, we see risk that China headwinds are likely to get stronger rather than weaker.” He also lowered his China same-store sales growth estimates for fiscal 2024 and 2025. “Herein we highlight 1) low-priced competition that is gaining share, with aggressive discounts that are poised to persist for the next 2+ years & 2) China macro headwinds … that bode poorly for consumer spending.” What history shows: Starbucks only beats earnings expectations 55% of the time, according to Bespoke, but the stock averages a 0.5% gain on earnings days. Apple is set to report earnings after the close. Corporate leadership is set to hold a call at 5 p.m. ET. Last quarter: AAPL exceeded expectations thanks to services revenue growth of 8%. This quarter: Apple is forecast to report a slight year-over-year revenue decline, per LSEG. What CNBC tech reporter Kif Leswing is watching: “Apple could post its fourth consecutive quarter of revenue declines on Thursday, marking an extended rough patch for the company, although the stock hasn’t suffered this year. Other problems for CEO Tim Cook on the horizon include falling iPad sales, partially because Apple didn’t release new ones, and issues with China’s government. But if Apple guides back to growth in the all-important holiday season, all of Apple’s 2023 problems could be forgotten.” What history shows: Apple shares tend to do well on earnings days, averaging a 1.3% advance, according to Bespoke. Shares have also risen in four of the last five earnings days. — CNBC’s Michael Bloom contributed reporting.

[ad_2]

Source link